When you pick up a prescription for metformin, lisinopril, or atorvastatin, you might assume you're getting a bargain because it's a generic. But here's the truth: generic price wars don't always mean lower prices at the pharmacy counter. The savings are real-just not always for you.

How Generic Drug Price Wars Actually Work

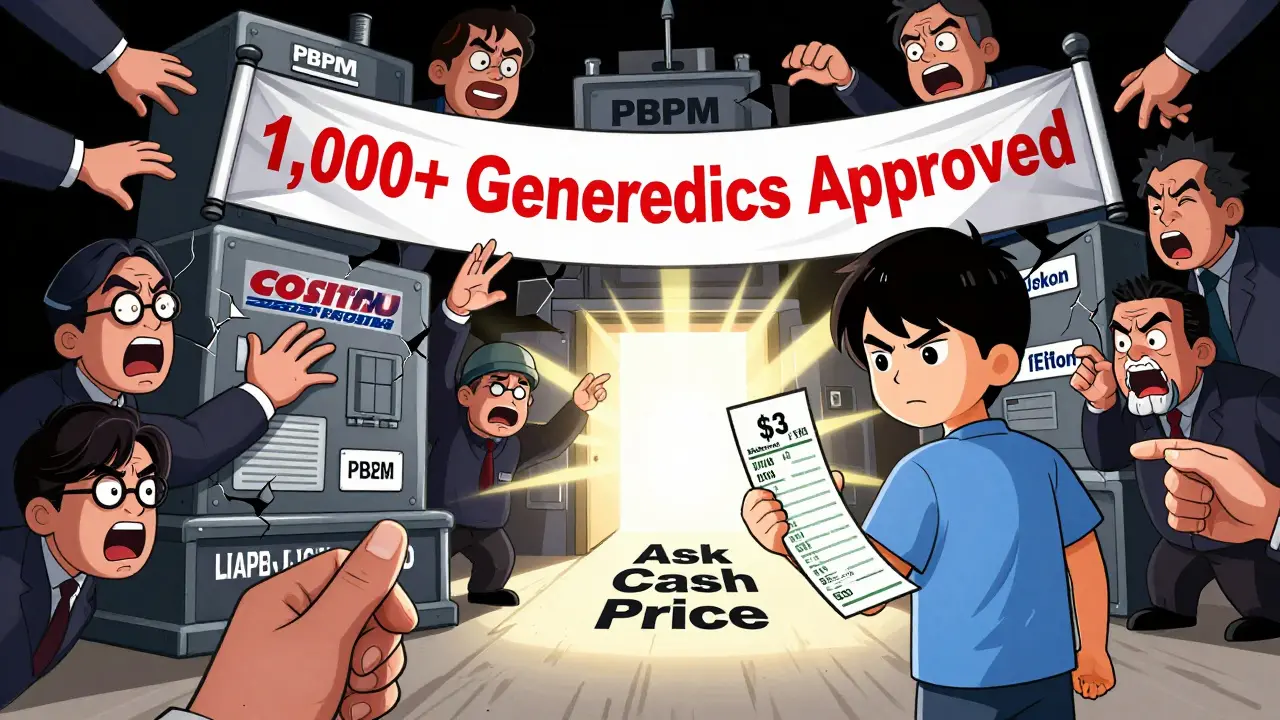

When a brand-name drug loses its patent, other companies can legally make the same medicine. These are called generics. They don't need to repeat expensive clinical trials. All they have to prove is that they work the same way. That cuts costs dramatically. But here’s where things get messy: the moment one generic hits the market, others follow. And that’s when the real price battle begins. The FDA tracks this closely. Their data shows that with just two generic makers, prices drop about 54% compared to the brand. With four, you’re looking at 79% off. And when six or more companies are selling the same drug? Prices fall over 95%. That’s not theory-it’s fact. In 2023, the FDA approved over 1,000 new generics, the highest number ever. More competition should mean more savings, right? But here’s the catch: those savings don’t always reach you.Why You Might Still Pay Too Much

The system isn’t broken-it’s layered. Between the drug manufacturer and your pocket sits a chain of middlemen: pharmacy benefit managers (PBMs), insurers, and pharmacies. PBMs negotiate prices with drug makers, set copays, and decide which drugs get covered. They make money by keeping the difference between what they pay the drug maker and what they charge your insurer-or you. This is called “spread pricing.” A PBM might pay a pharmacy $2 for a 30-day supply of generic lisinopril. But they charge your insurance $25. Your copay? $10. You think you’re saving money. But the $15 difference? That’s the PBM’s profit. You’re not seeing the real discount. Even worse, some insurance plans have “gag clauses”-rules that used to stop pharmacists from telling you the cash price was lower than your copay. Those were banned in 2018, but many people still don’t know to ask. In 28% of cases studied by the USC Schaeffer Center, the cash price was cheaper than the insurance price. You’re paying more because you don’t know the alternative.The Real Savings Are Hidden in Plain Sight

Let’s say your insurance says your generic metformin costs $15 with a copay. But if you walk in and ask for the cash price? It’s $4 at Walmart. Or $3 at Costco. Or $0 if you’re on a discount program. That’s not a fluke. It’s the result of a price war between manufacturers-but the savings are being absorbed by intermediaries. GoodRx tracks this. In 2023, their data showed an average 89% savings on generics compared to brand names. But that number varies wildly. For insulin biosimilars? Only 15% off. Why? Because only two companies make them. No competition. No price war. Just high prices. The same thing happened with apixaban, a blood thinner. When five companies started making it, the price dropped from $400 to $40. But when one manufacturer quit due to low margins? The price jumped back to $120. That’s the dark side of price wars: when profits vanish, companies leave. And then you’re stuck paying more.

Who Controls the Market?

It’s not a free-for-all. Five companies-Teva, Viatris, Sandoz, Amneal, and Aurobindo-control over 60% of the U.S. generic drug market. That’s not competition. That’s an oligopoly. When a handful of players dominate, they can coordinate pricing without breaking the law. They don’t need to slash prices aggressively because there’s no real threat of a new entrant. The Federal Trade Commission called this out in a 2023 report. They found PBMs and big generic makers often work together to keep prices high. One example: PBMs favor certain generics not because they’re cheaper, but because they get bigger rebates. That’s not helping you. That’s helping their bottom line. Meanwhile, small generic makers struggle. They can’t afford the legal and regulatory costs to enter the market. So even when a drug should have 10 competitors, it only has two. And prices stay high.How to Actually Save Money

You can’t fix the system. But you can beat it. First: Always ask for the cash price. Don’t assume your copay is the lowest. Pharmacies have access to discount networks like GoodRx, SingleCare, or their own bulk deals. You don’t need insurance to use them. In fact, cash prices are often lower than insured prices. Second: Compare prices across pharmacies. The same generic drug can cost $5 at CVS, $12 at Walgreens, and $1.50 at Target. That’s not a typo. It’s the result of different PBM deals and store pricing strategies. A 300% difference isn’t rare. Third: Use discount apps. GoodRx, SingleCare, and Blink Health let you print or show a coupon at the counter. They’re free. They work. And they’re backed by real price data from thousands of pharmacies. Fourth: Stick to chronic meds. A $5 difference on a monthly pill adds up to $60 a year. On a $100 drug? That’s $1,200. Focus your savings efforts on the drugs you take every day. Fifth: Check therapeutic equivalence. The FDA rates generics with an “AB” code. If it says AB, it’s bioequivalent. If it’s BX? It might not work the same. Don’t assume all generics are equal.

The Bigger Picture: Why This Matters

Americans spend $450 billion a year on prescriptions. Generics make up 90% of prescriptions but only 23% of that cost. That’s a massive savings-if it reaches you. Right now, billions are going to PBMs, insurers, and shareholders instead of your wallet. The government is trying to fix this. The Inflation Reduction Act lets Medicare negotiate drug prices. The Pharmacy Benefit Manager Transparency Act is moving through Congress to ban spread pricing. The FDA is fast-tracking approvals for drugs with few competitors. But none of that helps you today. Your power lies in knowing how to shop. You don’t need to be an expert. You just need to ask one question: “What’s the cash price?”What’s Next for Generic Drugs?

The number of generic approvals keeps rising. More drugs will come off patent in the next five years-insulin, Humira, and others. That should mean more competition, more price drops. But history shows us that without transparency and real competition, savings disappear. Shortages are already happening. When prices drop too low, manufacturers quit. Then you’re stuck paying more. The goal isn’t to make generics cheap. It’s to make them affordable for you. Right now, the system is designed to hide savings. But you can still find them. You just have to look harder than ever before.Why are generic drugs sometimes more expensive than brand names?

Generic drugs are usually cheaper, but not always. If only one or two companies make a generic, there’s little competition, so prices stay high. Some generics are priced near brand levels because manufacturers know patients have no other option. Insurance formularies and PBM rebates can also push you toward more expensive generics that pay higher kickbacks.

Does insurance always save money on generics?

Not always. In nearly 3 out of 10 cases, the cash price for a generic is lower than your insurance copay. This happens because PBMs charge insurers more than they pay pharmacies, and you end up paying the difference. Always ask the pharmacist for the cash price before using insurance.

Can I use GoodRx with insurance?

You can’t combine GoodRx with insurance, but you can choose which to use. If the GoodRx price is lower than your copay, pay cash using the coupon. Many pharmacies let you switch at the register. Just say, “I’d like to use my GoodRx coupon instead of insurance.”

Why do generic drug prices change so often?

Prices shift because manufacturers enter or leave the market. When a new company starts making a drug, prices drop. When one quits due to low profits, prices spike. It’s not random-it’s a direct result of competition levels. A drug with five makers might cost $5. With one maker? $50. That’s why checking prices monthly matters.

Are all generic drugs the same quality?

Yes-if they’re rated AB by the FDA. That means they’re bioequivalent to the brand. But some generics are rated BX, which means they’re not proven to work the same. Always check the label or ask your pharmacist. Don’t assume “generic” means identical.

What should I do if my generic suddenly gets more expensive?

First, check if the manufacturer changed. Sometimes the pill looks different because a new company took over. Then, compare prices at other pharmacies using GoodRx or by asking for cash prices. If the price jumped without warning, it’s likely due to reduced competition. You may need to switch brands or use a discount program.

Do pharmacy loyalty programs help with generic prices?

Some do, but not always. Walmart’s $4 list and Costco’s cash prices are often the cheapest. Other loyalty programs may offer small discounts, but they rarely beat GoodRx or cash prices. Don’t rely on them. Always compare.

9 Comments

Write a comment

More Articles

Buy Generic Cymbalta (Duloxetine) Online Cheap in 2025: Safe Sources, Prices, and Risks

Want cheap generic Cymbalta online without getting burned? Here’s a 2025 buyer’s guide: safe pharmacies, real prices, risks, and smart ways to save.

Laia Freeman

January 29, 2026 AT 09:01OMG I JUST REALIZED I’VE BEEN OVERPAYING FOR MY LISINOPRIL FOR YEARS!!! I ASKED FOR THE CASH PRICE AT CVS AND IT WAS $3.50. MY INSURANCE COPAY WAS $12. I FEEL LIKE SUCH A FOOL. WHY DOESN’T ANYONE TELL YOU THIS?!?!?!?!?!?!