Every year, Americans spend over $650 billion on prescription drugs. That’s more than any other country in the world. But here’s the twist: generics make up 90% of all prescriptions filled, yet they only account for 12% of that total cost. Meanwhile, brand-name drugs, which make up just 10% of prescriptions, eat up 88% of the spending. That’s not a mistake. It’s the power of generics at work.

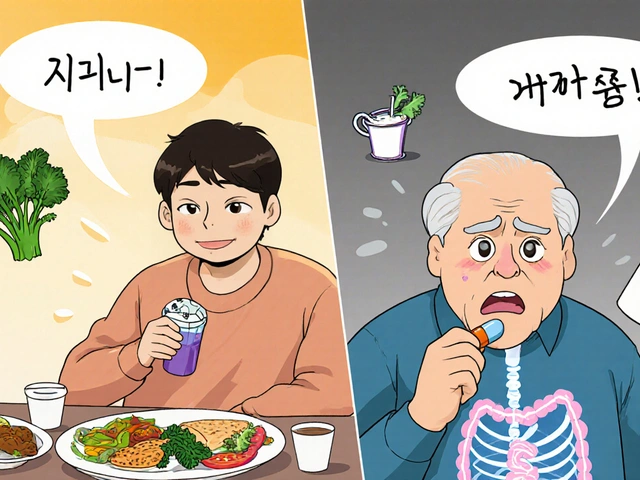

What Exactly Are Generic Drugs?

Generic drugs aren’t cheap knockoffs. They’re exact copies of brand-name medications - same active ingredient, same strength, same way of taking them. The FDA requires them to meet the same strict standards for safety, purity, and effectiveness. The only differences? The name, the color, the shape, and the price. And sometimes, the inactive ingredients - like fillers or dyes - which can cause minor reactions in rare cases. The legal backbone for generics came from the Hatch-Waxman Act of 1984. Before that, companies had to run full clinical trials to prove a new drug worked - even if it was just copying an existing one. Hatch-Waxman changed that. It let generic makers prove their drug was bioequivalent - meaning it behaves the same way in the body - using smaller, faster, cheaper studies on healthy volunteers. That cut development time from 10-15 years to under a year and slashed costs from $2.6 billion to around $1 million per application.How Much Do Generics Actually Save?

The numbers speak for themselves. In 2024, generics saved the U.S. healthcare system $98 billion in direct spending. That’s not a guess - it’s from the Association for Accessible Medicines. Compare that to brand-name drugs, which cost $700 billion for just 435 million prescriptions. That’s an 80-85% price drop on average. Take insulin, for example. Brand-name Humalog used to cost $350 a month. After generic insulin lispro hit the market, the same dose dropped to $25. One patient on Reddit said switching saved her mom from skipping doses. That’s not just money - it’s health. Even in Medicare, where 98% of plans automatically substitute generics, the savings ripple out. When a generic enters the market, prices for the brand-name version often drop too - sometimes by 90% within a year. The Congressional Budget Office found that generic competition cuts prices far more than Medicare’s new price negotiation program, which only applies to a handful of drugs each year.Why Don’t We Use More Generics?

You’d think with savings like that, everyone would switch. But barriers remain. One big one? Patent games. Brand-name companies file dozens of patents - sometimes over 140 per drug - not to protect innovation, but to delay generics. They tweak the pill’s coating, change the dosage form, or make minor updates just to reset the clock. This tactic, called “product hopping,” can delay generics by 6 to 12 months. Add in lawsuits and “pay-for-delay” deals - where brand companies pay generics to stay off the market - and the average wait for a generic after patent expiry is 28 months. Then there’s the pharmacy benefit managers (PBMs). These middlemen negotiate rebates with drugmakers. But here’s the catch: sometimes, they structure plans so that the generic costs more out-of-pocket than the brand. Why? Because the rebate on the brand is bigger. Express Scripts reported in 2024 that 45% of commercial plans charge higher copays for generics when rebates outweigh the price difference. That’s backwards economics - and it hurts patients.

The Biosimilar Gap

Biologic drugs - like those for rheumatoid arthritis, cancer, or Crohn’s disease - are complex molecules made from living cells. They can’t be copied exactly, so their cheaper versions are called biosimilars. They’re not generics, but they’re close: same effect, lower cost. Biosimilars typically cost 15-35% less than the brand. That sounds small compared to generics, but when you’re talking about drugs that cost $100,000 a year, even 20% off means tens of thousands saved. Yet adoption in the U.S. is stuck at 25-30%. In Europe, it’s 70-85%. Why? Rebates again. PBMs and insurers often keep the brand drug on top of the formulary because the rebate is higher. Doctors don’t always know how to switch. And patients fear change - even when studies show biosimilars work just as well. Worse, 90% of biologics losing patent protection in the next 10 years have no biosimilar in development. That’s a looming crisis. The FDA’s Biosimilars Action Plan is trying to fix this, but without policy changes to encourage development - like liability protections or faster approvals - we’ll keep seeing the same pattern: high prices, no competition.What About Safety?

People worry: “Is my generic the same?” The answer is yes - for most drugs. The FDA requires bioequivalence testing. That means the generic must deliver the same amount of drug into the bloodstream within the same time frame as the brand. The acceptable range? 80-125% of the brand’s levels. That’s not a loophole - it’s based on decades of clinical data showing no meaningful difference in outcomes within that range. But there are exceptions. For drugs with a narrow therapeutic index - like warfarin, lithium, or levothyroxine - even tiny changes can matter. Some patients report symptoms returning after switching to a generic version of levothyroxine. The FDA acknowledges this and requires prescribers to specify “dispense as written” on the prescription in those cases. In 12 states, that’s the law. Still, out of 1.2 million patient reviews on Drugs.com, generics scored 4.1 out of 5 for overall satisfaction - almost identical to brands. Efficacy ratings were the same. The only big difference? Affordability. Generics got 4.5 out of 5. Brands? 2.3.

Who Makes These Drugs?

The U.S. doesn’t make most of its generic drugs anymore. Over 80% of the active ingredients come from India and China. That’s efficient - but risky. During the pandemic, supply chain snarls caused over 300 drug shortages, mostly generics. The FDA now tracks 127 drugs at high risk of shortage due to manufacturing issues. The biggest generic makers in the U.S. are Teva, Viatris, and Sandoz. But behind them are hundreds of smaller companies, many in Asia, that produce the raw materials and finished pills. This global network keeps prices low - but also makes the system vulnerable to political or natural disruptions.What’s Next?

The Inflation Reduction Act capped insulin at $35 a month for Medicare patients in 2023. That forced brands like Eli Lilly to slash prices across the board - from $275 to $25. It’s a sign that policy can shift markets. The CBO estimates that if we fix the biosimilar void - by speeding up approvals and banning pay-for-delay - we could save $234 billion over the next decade. That’s bigger than Medicare negotiation alone. But real change needs more than laws. It needs transparency. It needs prescribers who know how to read the FDA’s Orange Book - a database that tells them which generics are interchangeable. Only 37% of doctors can do that without help. It needs pharmacies that don’t charge more for generics. It needs insurers that stop rewarding the most expensive options. And it needs patients who know they have a right to ask for the generic - and that it’s not just cheaper, it’s just as good.Final Thoughts

Generics aren’t a band-aid. They’re the foundation of affordable healthcare. Without them, millions would skip doses, ration pills, or go without treatment. They’re the reason a diabetic can afford insulin, a heart patient can take their statin, and a senior on fixed income can keep their blood pressure under control. The system isn’t perfect. Patent abuse, supply chain risks, and perverse incentives still exist. But the data is clear: when generics enter the market, prices crash, access expands, and lives improve. The next time you pick up a prescription, ask: Is there a generic? If the answer is yes - and your doctor says it’s safe - take it. You’re not saving money. You’re saving the system.Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand-name drug. They must also prove bioequivalence - meaning they deliver the same amount of medicine into your bloodstream at the same rate. Over 90% of generics are rated as therapeutically equivalent by the FDA. Patient reviews and clinical studies show no meaningful difference in effectiveness or safety for most drugs.

Why do some people say generics don’t work as well?

A small number of patients report issues after switching to generics, especially with drugs that have a narrow therapeutic index - like levothyroxine or warfarin. These drugs require very precise dosing, and even tiny differences in inactive ingredients can affect absorption in sensitive individuals. In these cases, some patients benefit from staying on the brand. But for 95% of drugs, switching causes no issue. Always talk to your doctor if you notice changes after a switch.

Why is my generic more expensive than the brand-name drug?

It shouldn’t be - but sometimes it is. Pharmacy benefit managers (PBMs) sometimes structure insurance plans so that the brand drug has a lower copay because they get a bigger rebate from the manufacturer. This is called a "generic differential." If your copay is higher for the generic, ask your pharmacist to check if there’s a cheaper option or if your plan can be adjusted. You can also use tools like GoodRx to compare cash prices.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs - like pills for high blood pressure or cholesterol. Biosimilars are highly similar versions of complex biologic drugs - like injectables for arthritis or cancer. Because biologics are made from living cells, they can’t be copied exactly. Biosimilars must show they work the same way and have no meaningful difference in safety or effectiveness, but they’re not identical. They’re typically 15-35% cheaper than the brand, compared to 80-85% for generics.

Can I ask my doctor to prescribe a generic?

Absolutely. In fact, most doctors automatically prescribe generics when available. But if yours doesn’t, ask. Say: "Is there a generic version of this?" or "Would a generic work just as well?" Your doctor may not know about the latest generic approvals, or they might be used to prescribing the brand. You have the right to request the most affordable, equally effective option.

How do I know if a generic is approved by the FDA?

Check the FDA’s Orange Book, which lists all approved generic drugs and their therapeutic equivalence ratings. Look for an "A" code - that means the generic is rated as interchangeable with the brand. You can search it online for free. Also, the label on the bottle will say the generic name, and your pharmacist can confirm its approval status.

10 Comments

Write a comment

More Articles

Calcium Carbonate vs Alternatives: What Works Best for Your Needs

Calcium carbonate is common but not always the best choice. Learn how calcium citrate, malate, and food sources compare-and which one suits your body best.

Statins and Pregnancy: What You Need to Know About Risks and Planning

Statins were once strictly avoided in pregnancy due to fears of birth defects. New data shows they're unlikely to cause harm-except in rare cases. Learn who should keep taking them, when to stop, and what the latest research says.

April Allen

February 1, 2026 AT 05:06Generics aren't just cost-cutting measures-they're a structural correction to a broken pharmacoeconomic model. The Hatch-Waxman Act didn't just lower prices; it reallocated R&D incentives away from me-too drugs and toward true innovation. What we're seeing now isn't market failure-it's rent-seeking disguised as innovation. The real issue isn't generic efficacy-it's the perverse alignment of PBMs, insurers, and pharma where rebates override patient outcomes. We've outsourced our health to spreadsheet algorithms.

And let's not ignore the geopolitical risk: 80% of API sourcing from two nations with divergent regulatory philosophies isn't supply chain optimization-it's systemic vulnerability. The FDA's backlog on biosimilar approvals? That's not bureaucracy-it's captured regulatory capture. We're paying for brand-name monopolies while pretending generics are the problem.

The 80-125% bioequivalence window? Validated by decades of pharmacokinetic modeling. But when you're talking about warfarin or levothyroxine, that window becomes a canyon for sensitive populations. That's why therapeutic substitution protocols need clinician discretion, not blanket policies. The FDA's Orange Book isn't a mystery-it's a public tool. The failure isn't in the science-it's in the dissemination.

And yet, the most dangerous myth isn't that generics are inferior. It's that they're 'good enough.' They're not. They're identical. And when we treat them as second-tier, we normalize health inequity under the guise of cost containment. The real scandal isn't the price drop-it's that it took a public outcry to force insulin down to $35 after 20 years of price gouging.

Generics are the most underappreciated public health intervention since vaccines. Yet we treat them like discount groceries instead of life-sustaining infrastructure.