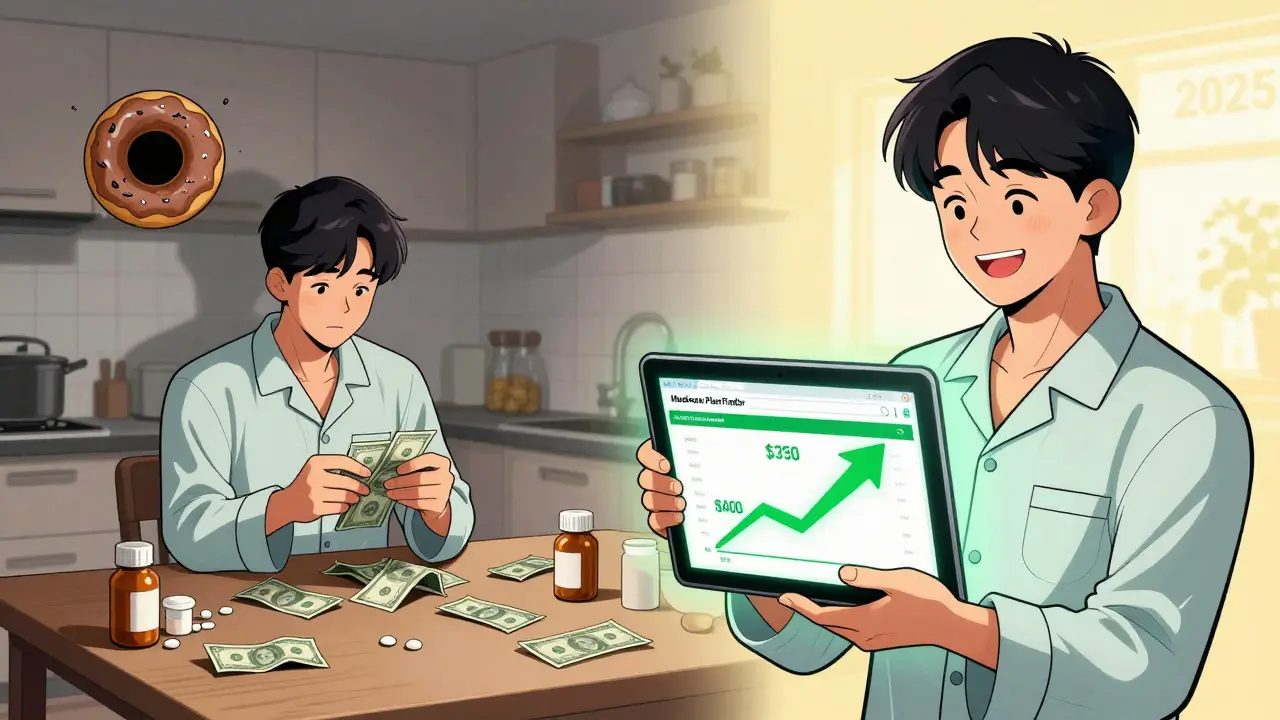

By the end of 2024, the Medicare Part D coverage gap-commonly called the donut hole-will disappear for good. But right now, it’s still real. If you’re paying for prescriptions and hit that gap, you could be stuck paying 25% of your drug costs out of pocket. For someone on a $1,200-a-month medication like Humira, that’s $300 a month just to stay alive. And if you’re on multiple drugs, those costs stack fast.

What the Donut Hole Actually Means in 2024

The donut hole isn’t a mystery. It’s a phase in your Medicare Part D plan where, after you and your plan have spent $5,030 on covered drugs in 2024, you enter a temporary gap in coverage. You don’t lose all coverage-you still pay 25% of the cost for both brand-name and generic drugs. But here’s the catch: the $5,030 isn’t what you pay. It’s what your plan and you combined have spent. That includes your copays, your deductible, and even the 70% discount drugmakers give on brand-name drugs. That discount counts toward getting you out of the gap, but it doesn’t lower your bill at the pharmacy counter.For example, if you take a brand-name drug that costs $1,000 a month, the manufacturer gives a $700 discount. Your plan pays $50. You pay $250. But the full $1,000 counts toward your $5,030 out-of-pocket spending threshold. So even though you’re only paying $250, you’re still moving closer to the next phase: catastrophic coverage, which kicks in after $8,000 in total spending.

That’s why people on expensive drugs get out of the donut hole faster than those on generics. Generics don’t get manufacturer discounts, so you pay more out of pocket to reach the $8,000 cap. In 2024, someone on only generics might spend $6,000 of their own money before hitting catastrophic coverage. Someone on brand-name drugs? Closer to $3,300.

Why the Donut Hole Is Disappearing in 2025

Starting January 1, 2025, the donut hole vanishes. You’ll pay no more than $2,000 out of pocket for all your Part D drugs in a year. After that, your medications are free. No more guessing. No more juggling doses. No more choosing between insulin and rent.This change comes from the Inflation Reduction Act of 2022. It’s the biggest shift to Medicare drug coverage since Part D started in 2006. The $2,000 cap doesn’t just help people in the gap-it helps everyone who takes multiple prescriptions. And it’s not a temporary fix. It’s permanent.

But here’s what you need to know: the rules are changing fast. The manufacturer discount program that gives you 70% off brand-name drugs during the donut hole ends December 31, 2024. In 2025, manufacturers will only give 10% off during initial coverage and 20% during catastrophic coverage. That means the $2,000 cap is your new safety net. You won’t need the discounts anymore-you’ll just stop paying after you hit $2,000.

What You Can Do Right Now (Before 2025)

If you’re already in or near the donut hole, you don’t have to wait. There are real, actionable ways to lower your costs before the system changes.- Check your plan’s formulary. Your drug might be in Tier 3 or Tier 4, which means higher coinsurance. Ask your pharmacist or log into your plan’s website. See if there’s a lower-tier alternative. Sometimes, switching from a brand-name drug to a generic saves you $1,200 to $2,500 a year.

- Use manufacturer patient assistance programs. Companies like Amgen, AbbVie, and Eli Lilly offer programs that can cut your out-of-pocket cost to $5 or $10 a month. For example, one woman on Repatha dropped from $560 to $5 during the donut hole by signing up. These aren’t hard to find-just search “[drug name] + patient assistance program.” Most take less than 15 minutes to apply.

- Ask for a 90-day supply. Many plans charge less for mail-order or 90-day fills. You might save 15-25% on each prescription. Plus, you reduce the number of times you hit the pharmacy counter, which helps if you’re close to the gap.

- Apply for Extra Help (Low-Income Subsidy). If your income is below $21,870 (single) or $29,580 (married), you qualify. This program pays your premiums, eliminates your deductible, and removes the donut hole entirely. In 2023, 12.6 million people got it. If you didn’t apply before, do it now. You can apply through Social Security or your state Medicaid office.

- Use the Medicare Plan Finder. Don’t just stick with your current plan because it’s “fine.” Use the tool on Medicare.gov to compare drug costs across plans. One study found people who switched based on their meds saved $1,047 a year on average. Look at your top three drugs. See which plan charges the least for them in the donut hole phase.

What People Are Actually Doing (Real Stories)

On Reddit and Medicare forums, people are sharing what works.One man with rheumatoid arthritis was paying $1,200 a month for Humira. He couldn’t afford food. He called his doctor, who switched him to a biosimilar-same effect, 30% cheaper. He also enrolled in the manufacturer’s assistance program. His new monthly cost: $75.

A woman on insulin took a different route. She applied for Extra Help and found out she qualified. Her insulin went from $400 a month to $0. She didn’t even know she was eligible until she called Medicare Rights Center.

But not everyone is so lucky. A 2023 survey by the Medicare Rights Center found that 68% of people who hit the donut hole had to skip doses, split pills, or delay refills. That’s not just inconvenient-it’s dangerous. High blood sugar, uncontrolled cholesterol, missed doses of heart meds-all lead to ER visits and hospital stays. The system was designed to save money. But it’s costing people their health.

What’s Coming in 2025 (And How to Prepare)

You don’t need to panic about 2025. You need to prepare.- Check your Annual Notice of Change (ANC). Plans mailed these in September 2024. It tells you what your premiums, copays, and coverage will be next year. Look for the new $2,000 out-of-pocket cap.

- Don’t assume your current plan is still the best. With the cap in place, some plans might raise premiums to offset the cost. Compare again in October 2024 during Open Enrollment.

- Keep using manufacturer discounts now. Even though they’re ending, they still help you reach the $8,000 catastrophic threshold faster. That means less out-of-pocket spending before 2025.

- Call your doctor. Ask if any of your meds can be switched to generics or lower-cost alternatives. Don’t wait until you’re in the gap.

The bottom line? The donut hole is ending. But if you’re in it now, you still need to act. You don’t have to choose between medicine and groceries. There are tools, programs, and options. You just have to use them.

Final Tip: Don’t Wait Until It’s Too Late

The biggest mistake people make? Waiting until they’re in the donut hole to look for help. AARP found that 74% of people didn’t know about cost-saving options until they were already paying full price for their meds.Start now. Even if you’re not close to the gap, review your plan. Ask about generics. Check if you qualify for Extra Help. Call your pharmacist. Use the Medicare Plan Finder. These steps take 20 minutes. They could save you thousands.

By January 1, 2025, the donut hole will be gone. But the habits you build now-knowing your drugs, asking questions, using assistance programs-will last a lifetime.

What is the Medicare Part D donut hole in 2024?

The donut hole is the coverage gap in Medicare Part D that starts after you and your plan have spent $5,030 on covered drugs in 2024. During this phase, you pay 25% of the cost for both brand-name and generic drugs. Manufacturer discounts on brand-name drugs count toward getting you out of the gap, but you still pay out of pocket until you hit $8,000 in total spending.

Will the donut hole still exist in 2025?

No. Starting January 1, 2025, the donut hole will be eliminated. You’ll pay no more than $2,000 out of pocket for all your Medicare Part D drugs in a year. After that, your medications will be free for the rest of the year.

How can I save money on prescriptions if I’m in the donut hole?

Switch to generic drugs when possible, ask for a 90-day supply through mail-order pharmacies, apply for manufacturer patient assistance programs (which can cut costs by up to 90%), and check if you qualify for Extra Help (Low-Income Subsidy). Use the Medicare Plan Finder to compare drug costs across plans.

Do manufacturer discounts count toward the $2,000 cap in 2025?

No. In 2025, only what you actually pay out of pocket counts toward the $2,000 cap. Manufacturer discounts will no longer be part of the calculation. The cap is based on your real spending, not the drug’s list price.

Can I get help if I can’t afford my medications right now?

Yes. Apply for Extra Help through Social Security if your income is under $21,870 (single) or $29,580 (married). You can also contact your state’s Medicare Savings Program-37 states offer additional help. Many drugmakers have patient assistance programs that provide free or low-cost medications. Call 1-800-MEDICARE or visit Medicare.gov for support.

9 Comments

Write a comment

More Articles

How the FDA Ensures Generic Drugs Work the Same as Brand Names

The FDA ensures generic drugs work the same as brand names through strict bioequivalence testing, identical active ingredients, and the same manufacturing standards. Over 90% of U.S. prescriptions use generics, saving billions annually.

Renal Ultrasound and Imaging: Evaluating Obstruction and Size

Renal ultrasound is the safest, most widely used first-line tool for evaluating kidney obstruction and size. It detects hydronephrosis, measures kidney length and blood flow, and avoids radiation - making it ideal for kids, pregnant patients, and repeat monitoring.

Top Alternatives to FelixForYou.ca for Telemedicine in 2025

Discover the leading alternatives to FelixForYou.ca, a Canadian telemedicine platform, focusing on digital healthcare options available in 2025. Highlighting Maple Health, Tia Health, Livewell, Telus Health, and Jill Health, this article provides insights into each service's offerings, pros, and cons. Whether looking for 24/7 access to healthcare professionals, adaptable programs, or specialized medical services, these alternatives cater to varied health needs. Consider factors such as accessibility, cost, and service range to choose the right telemedicine solution.

Rajni Jain

December 26, 2025 AT 21:18i just applied for extra help last week and got approved in 3 days. my insulin went from $380 to $0. i didnt even know i qualified til my neighbor told me to check. dont wait like i did. you deserve to breathe without counting pills.