Most people don’t realize their health plan is secretly steering them toward cheaper pills. It’s not a trick-it’s insurance benefit design, and it’s one of the biggest reasons your monthly drug bill isn’t even higher. If you’ve ever picked up a prescription and paid $5 for a pill that used to cost $50, you’ve seen this system in action. Behind the scenes, your insurer, pharmacy benefit manager (PBM), and employer have all built rules to push you toward generic drugs. And it’s working-big time.

How Generics Became the Default Choice

In the 1980s, Congress passed the Hatch-Waxman Act, which created a legal shortcut for generic drug makers. Instead of running full clinical trials like brand-name companies, generics just had to prove they worked the same way. That cut development costs by 80% or more. Fast forward to 2025, and 91.5% of all prescriptions filled in the U.S. are generics. But here’s the kicker: they make up only 22% of total drug spending. That’s the power of smart design.

Health plans didn’t just hope people would choose generics-they built financial incentives into every layer of coverage. The most common tool? Tiered formularies. Think of it like a pricing ladder. Tier 1 is where generics live. Copays there are often $0 to $10 for a 30-day supply. Tier 2? That’s where preferred brand-name drugs sit, usually $25 to $50. Tier 3? Non-preferred brands, often $60 or more. If your plan says you pay $10 for a generic but $45 for the brand, you’re not just saving money-you’re being nudged. And most people follow the path of least resistance.

How Plans Force the Issue

It’s not always optional. Many plans use mandatory substitution rules. If a generic exists, your pharmacist can switch it without asking your doctor. All 50 states allow this, and 49 let pharmacists make the swap without prior approval. That means even if your doctor wrote “Dispense as Written,” the system overrides it.

Then there’s step therapy. If you need a brand-name drug, your plan might require you to try the generic first. You can’t get the expensive version until you’ve tried-and failed-the cheaper one. Over 92% of Medicare Part D plans use this rule. It sounds strict, but it’s not arbitrary. Studies show it reduces brand use by nearly 30% without hurting health outcomes.

Some plans go even further. Closed formularies ban brand-name drugs entirely if a generic is available. One Medicare HMO that switched to this model saw brand drug use drop by 28.7%. That’s not a small win-it’s a system-wide reset.

Who’s Saving Money? (And Who’s Not)

The numbers are staggering. From 2013 to 2022, generic drugs saved the U.S. healthcare system $3.7 trillion. That’s $370 billion a year. Medicare Part D saved $1.2 billion in 2022 alone just by pushing generics. Medicaid programs hit 89.3% generic dispensing rates-higher than commercial plans. Self-insured employers saw 9% to 15% savings when they swapped out expensive brands for generics, with zero drop in patient health.

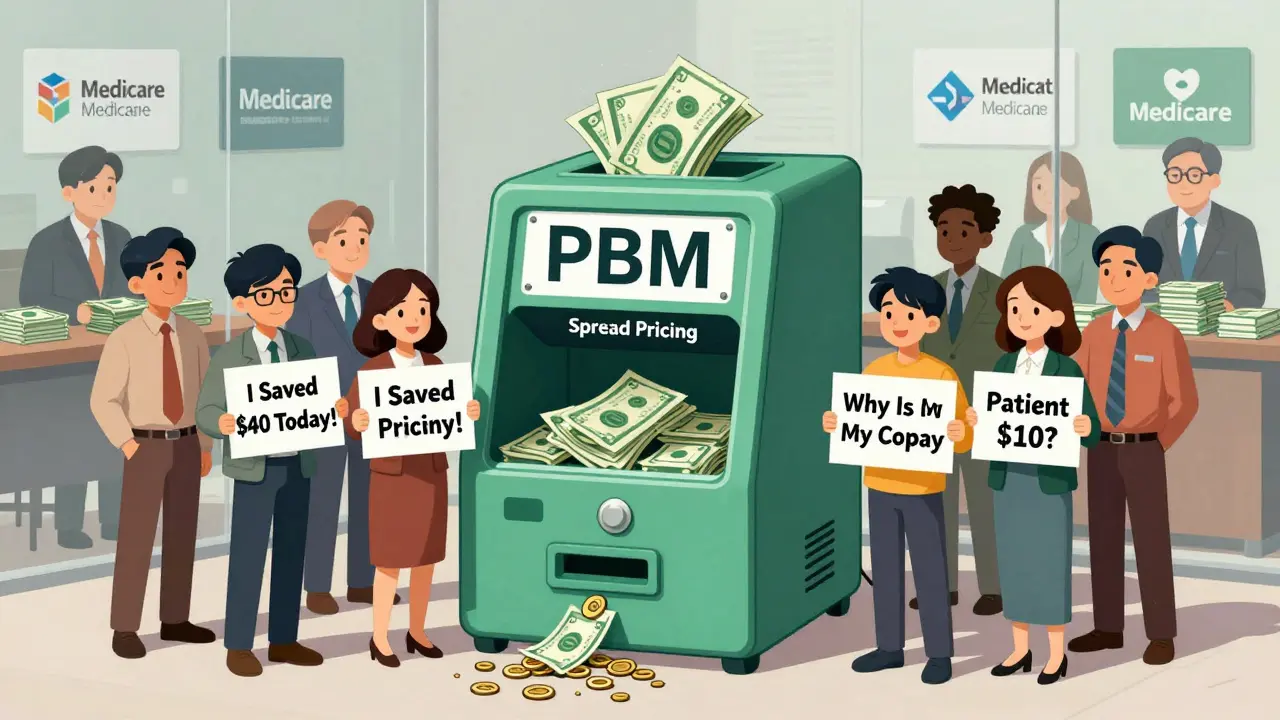

But here’s where it gets messy. You might think you’re saving $40 on a prescription. But sometimes, you’re not. Pharmacy benefit managers (PBMs)-the middlemen between insurers, pharmacies, and drug makers-have a pricing system that’s opaque. They collect payments from your plan, pay the pharmacy, and keep the difference. That gap? It’s called “spread pricing.”

Research from the USC Schaeffer Center found patients were overpaying $10 to $15 per generic prescription because of this. Your copay is $10, but the pharmacy only got $5 from the PBM. The rest? Kept by the middleman. And until 2025, most people had no idea. New federal rules now require insurers to break down these costs on your Explanation of Benefits (EOB), so you can finally see where your money goes.

Medicare, Medicaid, and the New Rules

Medicare Part D has been the biggest driver of generic use. Since 2006, it’s used standardized tiers with low copays for generics. In 2024, some Part D plans charge $0 for generics. A Kaiser Family Foundation survey found 68% of seniors were satisfied with their generic coverage-compared to just 42% for brand-name drugs. But 22% still struggled to get prior authorization for brand drugs, and 14% said their doctor had to appeal multiple times.

Medicaid, which covers low-income patients, has even tighter controls. Federal rules cap what states can pay for generics at 250% of the average manufacturer price. Some states go further with reference pricing-paying the same amount for all drugs in a class, no matter the brand. That’s why Medicaid’s generic rate is higher than commercial plans.

Starting in 2026, the new CMS GENEROUS Model will let the federal government negotiate lower prices for Medicaid drugs directly with manufacturers. It’s a direct challenge to the PBM system. The goal? Cut Medicaid drug spending by $40 billion over ten years.

The Rise of Direct-to-Consumer Options

Some people are bypassing the whole system. The Mark Cuban Cost Plus Drug Company launched in 2022 and sells generics at transparent prices-cost plus 15%. No PBM, no hidden fees. In 2023, patients saved a median of $4.96 per prescription. For uninsured people, that’s life-changing. But for Medicaid or Medicare beneficiaries? No savings. The system still pays the PBM, not the direct pharmacy.

It’s not a full replacement, but it’s a wake-up call. If you can buy a generic pill for $3 instead of $15 through insurance, why wouldn’t you? More people are starting to ask that question.

What Patients Really Think

On Reddit, one user wrote: “My generic copay went from $5 to $0 last month. Anyone else?” Over 140 people replied. Eighty-seven percent said yes-and loved it. But 13% complained they couldn’t get certain generics because their plan didn’t cover them. Others reported being switched to a generic that caused side effects. One man said his blood pressure spiked after switching from a brand to a generic. His doctor had to fight to get the original back.

Doctors are noticing too. A 2023 Medscape poll found 31% had patients report adverse effects after forced generic switches. It’s rare, but it happens. Not because generics are unsafe-FDA requires them to be bioequivalent-but because of tiny differences in fillers, coatings, or absorption rates. For most people, it’s fine. For a few, it’s not.

Why This System Won’t Go Away

Three PBMs-CVS Caremark, OptumRx, and Express Scripts-control 83% of all prescription transactions. They’ve spent $127 million a year on software to track which generics to push, when, and to whom. They’ve built algorithms that predict which patients will switch and which will resist. Employers? 97% use them. Medicare? 100% use tiered formularies. It’s everywhere.

The Inflation Reduction Act added another layer: a $2,000 annual cap on out-of-pocket drug costs for Medicare Part D, starting January 2025. That sounds good, right? But it changes the math. If you’re paying $2,000 a year anyway, why not use the cheapest option? The system now rewards you for sticking with generics-even more than before.

Even critics admit it works. The Pharmaceutical Care Management Association says PBMs saved health plans $195 billion in rebates and discounts in 2022. The Congressional Budget Office estimates Medicare drug price negotiations will save $98.5 billion over ten years. The goal isn’t to eliminate brands-it’s to make generics the smart default.

What You Can Do

If you’re on a health plan, check your formulary. Look up your meds. See what tier they’re on. Ask your pharmacist: “Is there a generic version?” If you’re paying more than $10 for a generic, you might be overpaying. Ask your insurer: “What’s the actual cost of this drug?”

Some plans let you pay cash instead of using insurance if the cash price is lower. That’s legal. And it’s often cheaper. Use tools like GoodRx or the Mark Cuban Cost Plus Drug Company to compare prices. Don’t assume insurance always wins.

If you’ve had a bad experience with a generic switch-side effects, weird reactions-tell your doctor. Keep records. Fight for a brand if it’s medically necessary. You have rights.

And if you’re choosing a plan next year? Look at the generic copay. Don’t just look at the monthly premium. A $500-a-month plan with $0 generics might cost you less than a $300 plan with $40 copays. The real savings aren’t in the premium-they’re in the pill bottle.

The Bigger Picture

Generic drugs aren’t just a cost-cutting trick. They’re a public health tool. They make chronic conditions like high blood pressure, diabetes, and depression affordable. Without them, millions would skip doses-or skip treatment entirely.

But the system isn’t perfect. Profits are hidden. Patients are confused. And the middlemen are still getting rich off the gap between what you pay and what the pharmacy gets.

The future? More transparency. More direct options. More pressure on PBMs to stop gaming the system. And more patients who know how to play it smart.

For now, the message is clear: if you’re on a generic, you’re saving money. But you might not be getting all the savings. Know how the system works-and don’t be afraid to ask for more.

12 Comments

Write a comment

More Articles

Cancer Medication Combinations: Bioequivalence Challenges for Generics

Generic cancer drugs save money, but combining them introduces serious bioequivalence risks. Learn why swapping one component in a combo therapy can change outcomes-and how regulators, hospitals, and patients are adapting.

Antiseizure Medications and Generic Substitution: Risks and Best Practices

Generic antiseizure medications can save money, but for narrow therapeutic index drugs like lamotrigine and carbamazepine, even small changes in absorption can trigger seizures. Learn the risks, who’s most vulnerable, and how to protect yourself.

Statins and Pregnancy: What You Need to Know About Risks and Planning

Statins were once strictly avoided in pregnancy due to fears of birth defects. New data shows they're unlikely to cause harm-except in rare cases. Learn who should keep taking them, when to stop, and what the latest research says.

Siobhan K.

December 21, 2025 AT 02:37Let’s be real-this whole system is a masterclass in behavioral economics disguised as healthcare policy. Tiered formularies, mandatory substitution, step therapy-these aren’t ‘nudges,’ they’re financial coercion wrapped in clinical jargon. And don’t get me started on PBMs. They’re not intermediaries; they’re profit siphons with spreadsheets and power of attorney over your medicine cabinet. The fact that patients had to wait until 2025 to see their own EOBs is criminal.